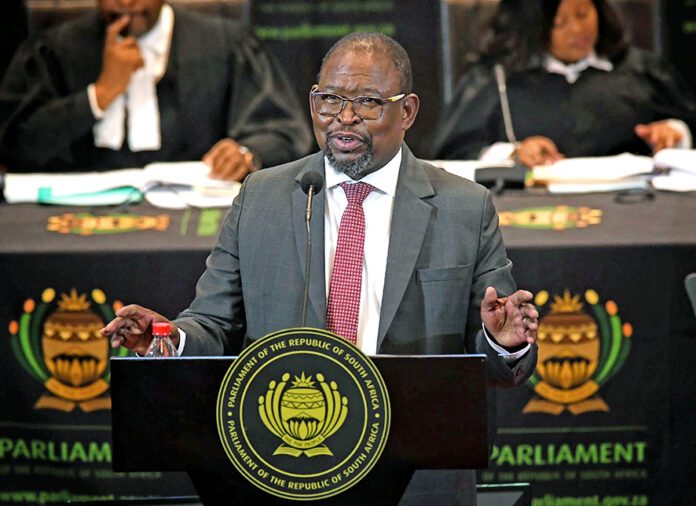

The budget speech last week by Finance Minister Enoch Godongwana revealed that the state would take over R254-billion in Eskom debt. Though this will help the power utility with its finances, it fails to deal with the fundamental issues.

“The debt relief arrangement for Eskom seems significant… however, it does nothing to assist in rectifying the deep structural issues plaguing the state-owned entity,” Anchor Capital wrote in a note.

Since loadshedding started in 2008, Eskom has faced many challenges, including poor planning, inadequate maintenance of its power plants and infrastructure, mismanagement and allegations of corruption.

Since the 2009 fiscal year, the government has provided the utility with R263.4-billion in bailouts.

The latest injection will take that to R517.4-billion. Yet in 2022, Eskom experienced a record loadshedding of 207 days, which devastated the local economy.

“While we welcome the financial measures minister Godongwana outlined to alleviate Eskom’s debt, we are aware that this intervention will not give the country urgently needed electricity soon,” Minerals Council’s chief economist Henk Langenhoven said.

Nedgroup Investments co-head of cash solutions Sean Segar said Godongwana missed an opportunity to kick-start the economy. “As far as Eskom’s balance sheet is concerned, the phrase ‘reshuffling the deck chairs on the Titanic’ comes to mind,” he added.

Godongwana said during his budget speech that the lack of reliable energy is the biggest constraint. A lack of the solution to Eskom’s woes could push the economy into recession.

Stellenbosch University research associate Roy Havemann wrote in a piece published by The Conversation, that Eskom’s debt relief would only fix the utility’s financial standing.

“But the plan won’t end power cuts,” Havemann added.

“One way to end electricity shortages is to allow competitively priced and privately funded generation at scale. This requires a reorganisation of South Africa’s electricity market,” he said.

Citadel’s chief economist Maarten Ackerman wrote in a note that while the 2023 budget speech brought some relief to cash-strapped citizens, new fiscal pressures brought on by Eskom and cost of living crises as well as caps on taxes put the country at risk of spiralling debt if there was no real economic growth this year.

“We are in a tight corner,” Ackerman said. However, he believes the budget contains good news for lower-income and middle-class South Africans, including that the state will extend the Covid-19 relief grant for another year; the fuel levy would not be

increased; the tax bracket would be adjusted to curtail “bracket creep” and transfer duties would only apply to properties valued at R1.1-million or more.

The government plans to reduce the fiscal deficit without resorting to tax increases or further cuts in social wages and infrastructure spending.

During the 2024 fiscal year, the government will provide tax relief of R13-billion.

“The budget strikes a balance between social spending and trying to fix the local economy’s crises,” Ackerman said.

London-based Capital Economics wrote that Godongwana largely pulled off the difficult task of sticking to fiscal prudence.

“The path to putting public debt on an even keel looks precarious,” it said

Godongwana announced a tax rebate for individuals of 25% of the cost of solar panels purchased and installed at a private residence from March 1 2023. This rebate is capped at R15 000 an individual.

In addition, businesses will get a tax incentive based on their renewable expenditure.

Another risk is that the SA government’s debt servicing costs are forecast to increase to R1-billion a day. Tax revenues exceeded estimates with the expectation of R1.69-trillion for the 2023 fiscal year, which exceeded last year’s budget estimate by R93.7billion and the mid-term budget by R10.3billion.

Anchor Capital believes the National Treasury’s economic growth forecasts are too optimistic.

“For example, the National Treasury forecasts economic growth of 0.9% for 2023, while we believe that the South African Reserve Bank’s estimate of 0.3% growth is more realistic,” Anchor added.

Stanlib chief economist Kevin Lings noted that SA’s macroeconomic environment was extremely challenging.

This severely limits the minister of finance’s policy choices, especially given the country’s need to attract and retain foreign investment and avoid further credit rating downgrades.

Matrix Fund Managers’ economist Carmen Nel said that SA’s credit rating was likely to remain steady following the issuing of the budget speech.

For more business news from Sunday World, click here.

Follow @SundayWorldZA on Twitter and @sundayworldza on Instagram, or like our Facebook Page, Sunday World, by clicking here for the latest breaking news in South Africa. To Subscribe to Sunday World, click here