Johannesburg -Behavioural finance is a relatively new field of study that looks at how our emotions and psychological biases affect our decision-making.

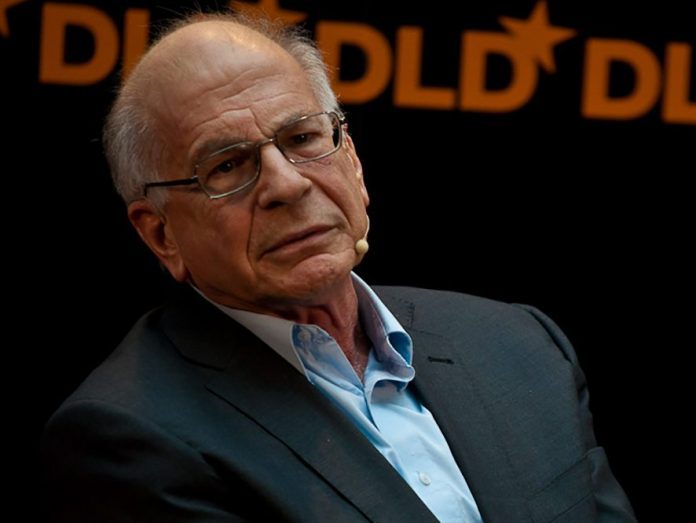

Amos Tversky and Daniel Kahneman, winners of the 2002 Nobel Prize in Economics, helped develop this fi eld of study with their development of Prospect Theory.

Prospect Theory was developed as model of human judgement and decision-making and att empts to explain how people manage risk and uncertainty.

Tversky and Kahneman found that people’s attitudes and responses varied when faced with the prospect of gains versus losses.

They found that while investors are inherently risk-avoiding, when faced with the probability of losses, investors can become risk-seeking in their eff orts to avoid taking losses.

Traditional economic and financial models and theory is based on the assumption that individuals act rationally and consider all available information in their decision-making process and hence markets are effi cient.

Behavioural finance provides a diff erent lens on understanding how investors and markets behave and att empts to address the many market anomalies not addressed by efficient market theory.

“People tend to assess the relative importance of issues by the ease with which they are retrieved from memory – and this is largely determined by the extent of coverage in the media. Frequently mentioned topics populate the mind even as others slip away from awareness …” Daniel Kahneman – Thinking, Fast and Slow (2011) By understanding behavioural biases and how they affect decision- making, investors have the opportunity to moderate and adjust the inputs and improve on their economic outcomes. Below we list some of the more common behavioural biases. Anchoring Bias Anchoring is the tendency to use the fi rst piece of information or a specific level or value as a focal point or reference for decision- making.

Any additional or newer information is now interpreted with reference to the initial piece of information.

This limits the ability of this additional information updating or upgrading the base case formed from the initial piece of information.

Confirmation Bias This is the tendency to favour and seek information that confirms existing beliefs and reject information that contradicts existing beliefs.

We all have our favourite commentators or publications and, in many cases, these are favourites because the views expressed are in alignment with our own. In recent years, we have seen confirmation bias play out in politics as voters become more polarised, with each side holding strong in their beliefs.

Framing Effect Bias Framing bias occurs when the way data and information is presented (framed) affects decision- making. In investing, this bias can cause investors to focus on the sensational headlines of any negative development in markets and not adequately process the positive factors that remain in place. As the field of behavioural finance develops further, many asset managers have already incorporated learnings and behaviours from this field into their investment processes.

The nature of financial markets means that volatility and uncertainty are a regular feature and as these events unfold, they have the ability to trigger psychological biases and reactions.

This makes it even more important to have a sound financial plan focused on the long term supported by a financial adviser.

By Anil Thakersee

• Thakersee works for PPS Investments.

Follow @SundayWorldZA on Twitter and @sundayworldza on Instagram, or like our Facebook Page, Sunday World, by clicking here for the latest breaking news in South Africa. To Subscribe to Sunday World, click here.

Sunday World