The culture of stokvels has been with black people for generations, and these informal saving schemes have helped brighten up the festive season with Christmas goodies over the years.

The National Stokvel Association of South Africa in a research established there are over 11-million South Africans engaged in stokvels, some using these informal finance schemes to buy houses.

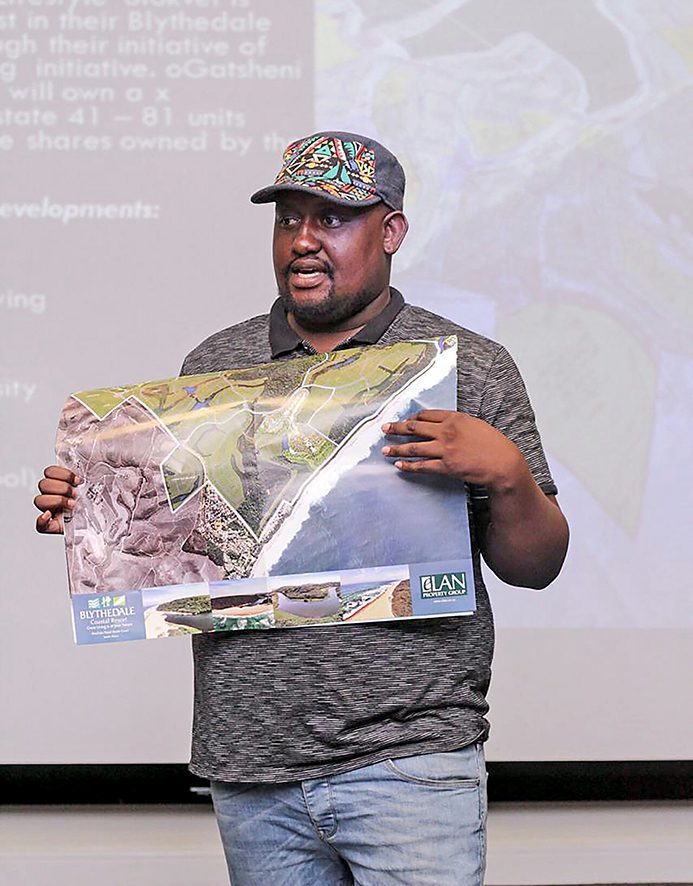

In KwaZulu-Natal,Durban-based businessman, Mhlekazi Ndhlovu, founded oGatsheni Property Stokvel, not to buy end-of-the-year festive groceries but to help people avoid taking hefty home loans that compel a buyer to pay a bond over 20 years with huge interest accumulated over the years.

Ndhlovu says home loans are dragging the black community back because all the interest accrued by banks could be used to finance other projects by home buyers if they had paid cash for their homes.

So how does a property stokvel work? Members contribute a monthly fee for a minimum of five years, thereafter they can either buy or build a house using the savings.

“A 20-year bond is one of the reasons people are hesitant to buy houses. They would rather rent, which is also not a wise move. They are trying to avoid a bond that comes back with huge interests,” says Ndhlovu.

He says he uses his company, oGatsheni Architectural and Engineering, which he founded in 2012, to build houses at competitive costs to members.

“I did research and found that other race groups have been into the stokvel property type of house buying for years now, but the majority of black people in the country have been sidelined. Some don’t know about joint saving to build or buy a house cash.

“I then thought it would be great to bring the idea to our black community so we can realise that building or buying a house is possible in less than 20 years, without any interests. “We just need patience and dedication to a saving culture using the stokvel as a vehicle to take people to their ultimate destination of owning a home.”

Ndhlovu said since he founded the stokvel finance scheme in 2018, they now have 700 members, and have managed to build five houses for their members and bought 10 within a period of four years, despite the pandemic between 2020 and 2021.

Explaining how it works, Ndhlovu says members choose what they want to invest their money on. It is either construction services, where they contribute between R3 500 and R15 000 for their dream home, owning property shares, or a house as their own property, while others invest in livestock.

“I felt with the skills and knowledge I have, I can build stokvel members perfect houses using my construction and engineering company – houses members have dreamt of and are within their budget.

“Although we are based in Durban, we are a national organisation. This has helped us grow and allowed us to open up and include more members because we are always on the go,” he says.

The property stokvel has spread its wings to include Property Youth Stokvel, with members contributing R300 to R1 500 for 36 months to encourage and inculcate a culture of saving.

The Bantu Fund is a five-year fixed savings option with each person contributing a minimum of R100 a month.

“The aim is to help people live a debt-free life or try to live with minimal debt. Having a house on bond for most people means living in fear. What happens if I lose my job? What happens if I get retrenched?

“Banks are not sympathetic, if you fail to service your bond, your house is repossessed, and you are blacklisted.

“We all deserve a roof over our heads. Owning our homes gives us peace of mind. We have included the youth in the saving scheme because we want to help people reach their dream, although we focus on houses, saving for the future starts as soon you get employed.

“As a worker it is important to embark on a disciplined saving strategy. Start early and gradually increase the amount every month, or every week if you are a weekly wage earner. We cannot overemphasise the importance of saving, so that you take responsibility of their finances.”

Ndhlovu emphasises that as much as the idea of the stokvel has always been mainly used to purchase Christmas gifts and festive season groceries, in the new millennium innovation has proved that joint saving schemes can be used to purchase valuable assets, and that is the very reason stokvels will always be with us for years to come.

For more business news from Sunday World, click here.

Follow @SundayWorldZA on Twitter and @sundayworldza on Instagram, or like our Facebook Page, Sunday World, by clicking here for the latest breaking news in South Africa. To Subscribe to Sunday World, click here.

Hi there i really need clarity ka the stokvel, I’m

Working and I can’t think clearly where to start or how to start building a dream house for my wife,Can u build and I continue paying or I join

then I contribute first?please help me.