While the rising cost of energy and its security, as well as the world economic order are set to dominate the agenda at this year’s instalment of the World Economic Forum (WEF) in Davos, Switzerland, another pertinent issue for South Africa is the acceleration of reforms that will make it compulsory for multinationals to live up to their tax obligations.

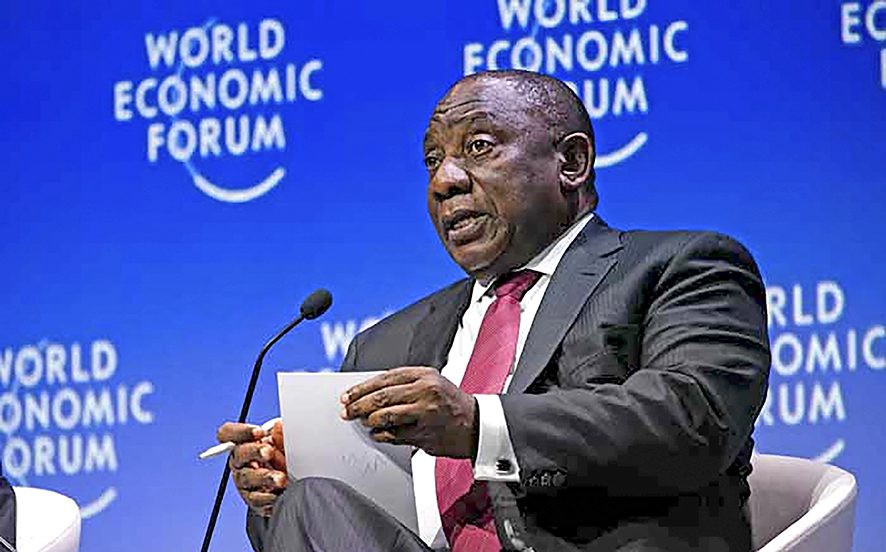

President Cyril Ramaphosa will lead the country’s delegation in Davos. The forum starts tomorrow and concludes on January 20.

The WEF brings together heads of state, policy makers and captains of world business and other economic sectors to deliberate on global sustainable development growth.

According to Brand South Africa, South Africa’s brand reputation and marketing agency, the delegation will use the gathering to position the country as a competitive business destination.

“Positioning South Africa at WEF 2023 remains imperative to showcase and provide an update on the country’s progress in implementing the economic reconstruction and recovery plan. Promoting the country’s economic reforms, advancing important public-private partnerships to support the country’s development objectives influencing global policy

discussions on the future of doing business [is paramount],” said the agency.

But another pressing debate is the transformation of the global corporate tax architecture. The Centre for New Economy and Society, a wing of the World Economic Forum, said taxation systems must be redesigned efficiently to tax capital and multinationals.

“Taxing such profits at excess rates could help mitigate some of the spending demands currently placed on government and contribute to restoring a fairer progressive global system,” noted the paper titled: Building Back Broader-Policy for an Economic Transformation.

Corporate taxes serve an important driver of revenue for developing countries, but the lack of transparency in the banking sector has allowed multinational companies to evade tax by shifting their profits in offshore accounts.

Treasury recently gazetted the Base Erosion Profit Shifting Multilateral Convention to bring the country in line with international standards on cross border transaction tracking and taxing. It is a multinational treaty which aims, among others, to update existing bilateral tax treaties to reduce illicit financial flows and tax avoidance.

Key ANC ally, the SACP has also raised its dissatisfaction with the government “That is why big capital does not respect us and part of the reasons they reneged on the social compact. When they were supposed to take responsibility and put resources, they showed government the middle finger because they realised that this government has no teeth. It allowed them to get away scot-free,” SACP’s Solly Mapaila said.

For more business news from Sunday World, click here.

Follow @SundayWorldZA on Twitter and @sundayworldza on Instagram, or like our Facebook Page, Sunday World, by clicking here for the latest breaking news in South Africa. To Subscribe to Sunday World, click here