Johannesburg – Unsavoury characters are exploiting the high indebtedness of South Africans to woo unsuspecting consumers into scams.

The National Credit Regulator (NCR) warns that the scams are mainly via online platforms and are aimed at deceiving consumers about debt intervention, which is a measure intended to assist debt-stressed consumers.

Anne-Carien du Plooy, manager: debt intervention at the NCR, said although the National Credit Amendment Act was signed into law, it is not yet in operation and awaits an implementation date to be promulgated.

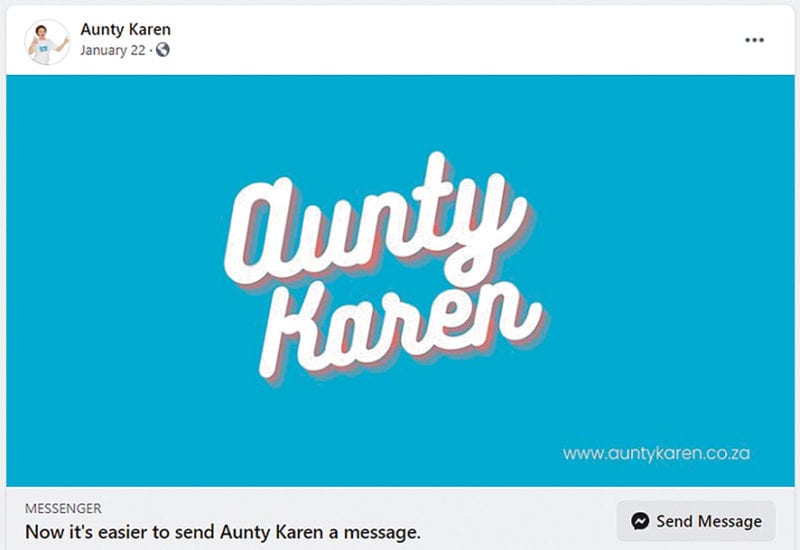

“This simply means that it is currently not in effect. The NCR has discovered several online scams, such as “ask.auntykaren.co.za”, which direct consumers to apply to certain companies in order to qualify for their debts to be written off under debt intervention,” she said.

“This is incorrect and misleading. It has to be emphasised that consumers will only be assisted for debt intervention once the act has been promulgated by the president. Consumers should beware these scams and avoid falling victims to them,” she said.

President Cyril Ramaphosa signed the National Credit Amendment Act into law on August 15 2019. A commencement date has not yet been fixed for the amendment act.

The amendment act provides additional protection to low-income consumers from over-indebtedness by either re-arranging, suspending or extinguishing (partially or wholly) their unsecured credit debts during a period of four years from the commencement date, which can be extended.

Qualifying consumers can extract themselves from over-indebtedness by applying for debt intervention at the NCR . The consumer can then be recorded as being under debt intervention at credit bureaux (similar to a debt review status flag).

The amendments will also allow eligible consumers to apply for various debt relief interventions, including

• Restructuring their debt repayment schedule over five years; alternatively suspending repayments for up to two years;

• Extinguishing the debt in whole or part if after two years the consumer is still unable to pay thier debt; and allowing courts to reduce interest charges. Du Plooy provides the following insights about “debt intervention” and how consumers can protect themselves:

• Consumers should not fall prey or victim to scams where companies and individuals direct them to pay for services with the promise that their debts will be written off.

• Consumers must verify such information with the NCR on 0860 627 627 before any payments are made or agreements entered into. • Consumers who are battling with the repayments on their debts can contact a registered debt counsellor directly for assistance.

• There is no basis for consumers to use agents to get to a debt counsellor and pay agent fees. • All registered debt counsellors can be found on the NCR’s website at www. ncr.org.za or consumers can contact the NCR on 0860 627 627 for assistance in this regard.

• Consumers are further cautioned to never share personal details such as ID numbers to strangers telephonically or online.

• A current scam that leads consumers to a website is https://ask.auntykaren. co.za.

Consumers are cautioned not to visit this website, to be vigilant and avoid this scam.

Also read: President Cyril Ramaphosa moves SA into adjusted alert level 4

Follow @SundayWorldZA on Twitter and @sundayworldza on Instagram, or like our Facebook Page, Sunday World, by clicking here for the latest breaking news in South Africa. To Subscribe to Sunday World, click here.

Sunday World